Every profession has its unique language and terms that are difficult for outsiders to understand, which is true for accounting. That’s why we have compiled a list of standard accounting and finance terms that you should know to avoid confusion the next time you talk to your accountant. Here are the most common accounting terms and their explanations:

- Assets: These are resources that a business owns or controls that have monetary value, including cash, property, inventory, equipment, etc. Assets can be classified into current assets that can be turned into cash within one year or fixed assets that provide value to the business for more than one year.

- Liabilities: These are amounts a business owes, including loans, accounts payable, accrued expenses, and more.

- Equity: This represents the value of a business, and it is measured by calculating the difference between assets and liabilities on the balance sheet. Equity also shows the worth of the owner’s interest/ownership of the business.

- Income statement (Profit and loss or P&L): This is a financial statement that shows a company’s expenses, costs, and revenues during a specific period of time. The statement starts with revenues earned, and then expenses are deducted until we get either a profit or loss.

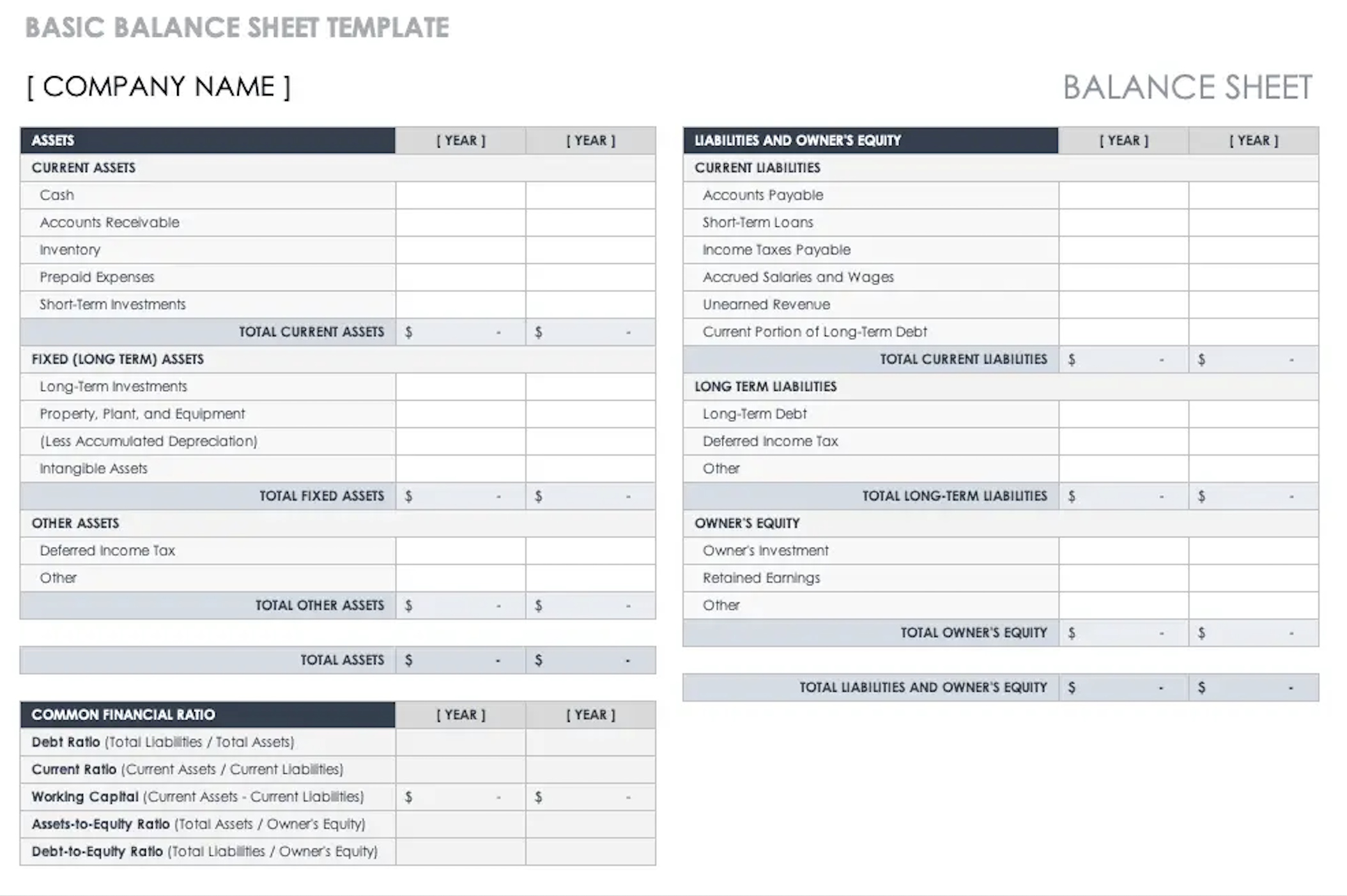

- Balance Sheet (statement of financial position): This financial statement reports a company’s assets, liabilities, and equity at a specific moment. A balance sheet is based on the Assets = Liability + Equity accounting equation.

- Cash flow statement: This financial statement reports how much cash is coming in and out of the business over a specific time.

- Accrual: This is the recognition of revenues or expenses before cash is exchanged. Revenues are recognized when earned, and expenses are recognized when incurred, not when cash is paid in a financial period.

- Depreciation: This is the decrease in the value of a fixed asset over time due to wear and tear or obsolescence. Depreciation affects assets like machinery and equipment, but land is not subject to depreciation.

- Amortization: This is the process of spreading the cost of an intangible asset over its useful life.

- Audit: This is a review of a business’s financial records and practices by an independent auditor to ensure accuracy and compliance with accounting standards.

- Generally Accepted Accounting Principles (GAAP): These are sets of accounting rules, standards, and principles that companies are required to follow when preparing and reporting financial data.

- Bookkeeping: This is the process of recording financial transactions and maintaining the financial records of a business. Bookkeepers often do this.

- Accounts receivable: This is the amount of money a company is owed by its customers from the sale of goods or services that have yet to be paid for. It is reported as a current asset on the balance sheet.

- Accounts payable: This is the amount of money a company owes to its creditors or suppliers for goods or services received/provided but still needs to be paid for. It is reported as a current liability on the balance sheet.

- Inventory: This refers to assets manufactured or purchased by the business for sale to its customers but are still located in the store.

- Cost of goods sold: These are expenses that directly relate to the manufacturing of a product or the provision of a service, such as the cost of materials or direct labor in service provision. However, this doesn’t include other costs of running a business. These additional costs are called overhead and include rent and salaries, among other things.

- Liquidity: This refers to how quickly an asset can be converted to cash. For example, stocks are more liquid than land because selling stocks and converting them to cash is easier.

- Credit Purchase or Account Purchase: This term refers to buying something on credit that will be paid for in the future.

- Trial Balance: A trial balance is a list of all accounts in the general ledger with their closing balances. It includes both debit and credit balances, and the two must equal each other.

- Credit (CR): Credit is an accounting entry that decreases an asset or expense account or increases a liability, income, or equity account.

- Debit (DR): Debit is an accounting entry that increases an asset or expense account or decreases a liability, income, or equity account.

- Insolvency: Insolvency is a state where a business can no longer meet financial obligations with lenders when its debts become due. This means that the company cannot pay its debts and obligations as they fall due. This often leads to bankruptcy applications.

- Limited Liability Company (LLC): A limited liability company is a separate legal entity or person from its owners. This means that the owners cannot be held responsible for the company’s debts and liabilities.

- Return on Investment (ROI): ROI is a measure of a business’s financial performance relative to the amount of money invested in the business. ROI is expressed as a percentage, and it is calculated by dividing the net profit by the cost of investment.

- Certified Public Accountant (CPA): A CPA is a professional designation for accountants who have passed the CPA exam and meet the mandated work experience and education requirements. These requirements vary in different states and countries.

There are many more accounting terms out there, but these are the most common ones. Knowing these terms can give you a solid foundation of accounting terminology and help you communicate effectively with accountants or handle your taxes and finances.