U.S. job growth remained steady in June, with 147,000 new positions added, above this year’s monthly average but below last year’s pace, while small businesses continue to face hiring difficulties, according to data from the Bureau of Labor Statistics (BLS) and the National Federation of Independent Business (NFIB).

The BLS reported June job gains exceeded the first half of 2025’s average monthly increase of 130,000 but fell short of 2024’s monthly average of 168,000. Revisions to April and May added 16,000 jobs to previously reported totals. Employment growth was also concentrated in healthcare and state government sectors, while federal government jobs declined.

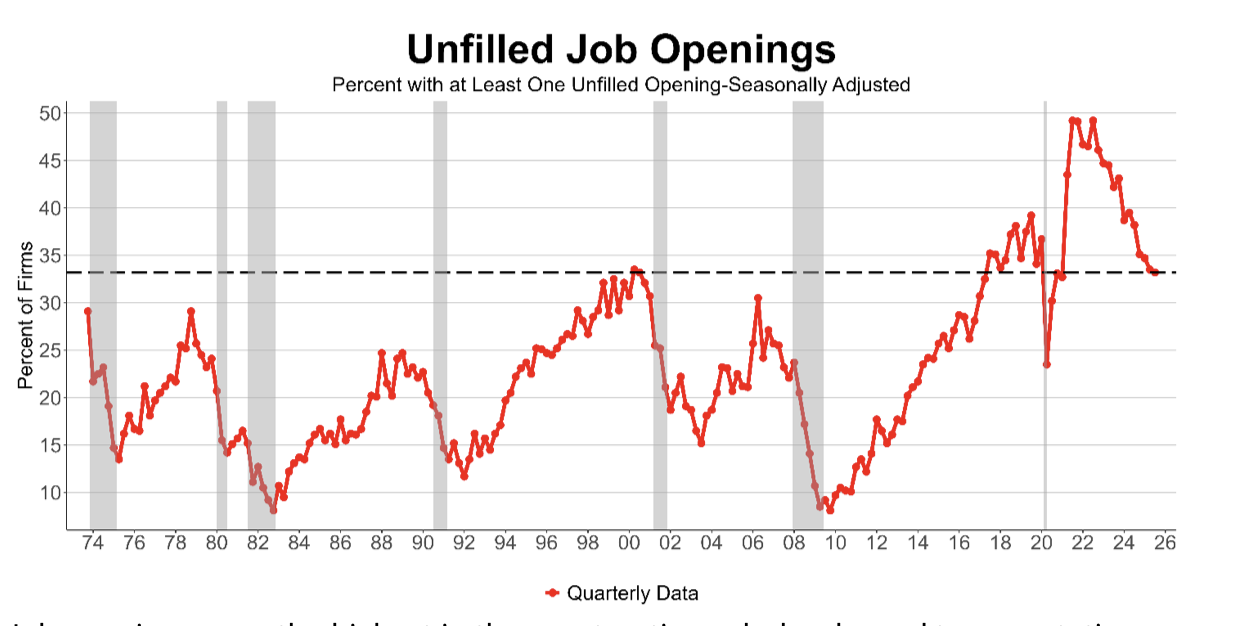

The NFIB’s July Small Business Economic Trends survey found that 33% of small business owners had job openings they could not fill, a three-point decline from June and the lowest level since December 2020, yet still above the historical average of 25%. Openings for skilled and unskilled workers also declined slightly.

Industries with the highest reported unfilled job openings included construction (55%), wholesale (42%), and transportation (41%). Meanwhile, the finance and agriculture sectors reported the lowest, with 13% and 15% respectively.

Small businesses continue to plan for growth, with a seasonally adjusted net of 14% of owners intending to add jobs in the next three months, slightly above the historical average of 11%. However, the share of owners actively hiring or trying to hire dropped slightly to 57%. Nearly half of those hiring reported few or no qualified applicants, a small improvement from June but still signaling a tight labor market.

Moreover, labor quality remained a pressing concern, which was cited as the single most important problem by 21% of owners, marking the largest monthly increase since August 2022. Meanwhile, labor costs, the top problem, declined marginally to 9%.

Compensation trends showed a slowdown, with a net 27% of owners raising pay in July, down six points from June, and only 17% planning future increases.

Economic growth continues to show signs of moderation. The surge in imports before the expected tariff increases negatively impacted the weak performance in the first quarter, as these imports do not contribute to the growth of the U.S. gross domestic product (GDP). Economists project that GDP growth will reach around 1% this year, leading to limited job and income growth. Slower expansion may ease pressure on wages and hiring, though tightness persists in some sectors.

Small business owners’ comments reflected ongoing struggles with labor availability and costs. Some reported difficulty attracting experienced workers despite growth opportunities, while others noted cutbacks in part-time and temporary labor due to rising minimum wages and cost concerns.

These dynamics illustrate a labor market that remains competitive yet gradually easing, with small businesses adapting to challenges in workforce quality, compensation, and hiring capacity amid slowing economic growth.

ASBN, from startup to success, we are your go-to resource for small business news, expert advice, information, and event coverage.

ASBN, from startup to success, we are your go-to resource for small business news, expert advice, information, and event coverage.