Each quarter, the MetLife & U.S. Chamber of Commerce Small Business Index quantitatively measures the results of around 1,000 online interviews with small business owners and operators. The interviews and surveys aim to help the Chamber asses the small business sector and investigate the viewpoints of small business owners on current business and economic trends. The Small Business Index also measures the small business population, including industry, employee size, and region.

For the purposes of this study, small businesses are defined as companies with fewer than 500 employees and are not sole proprietorships.

Key Findings

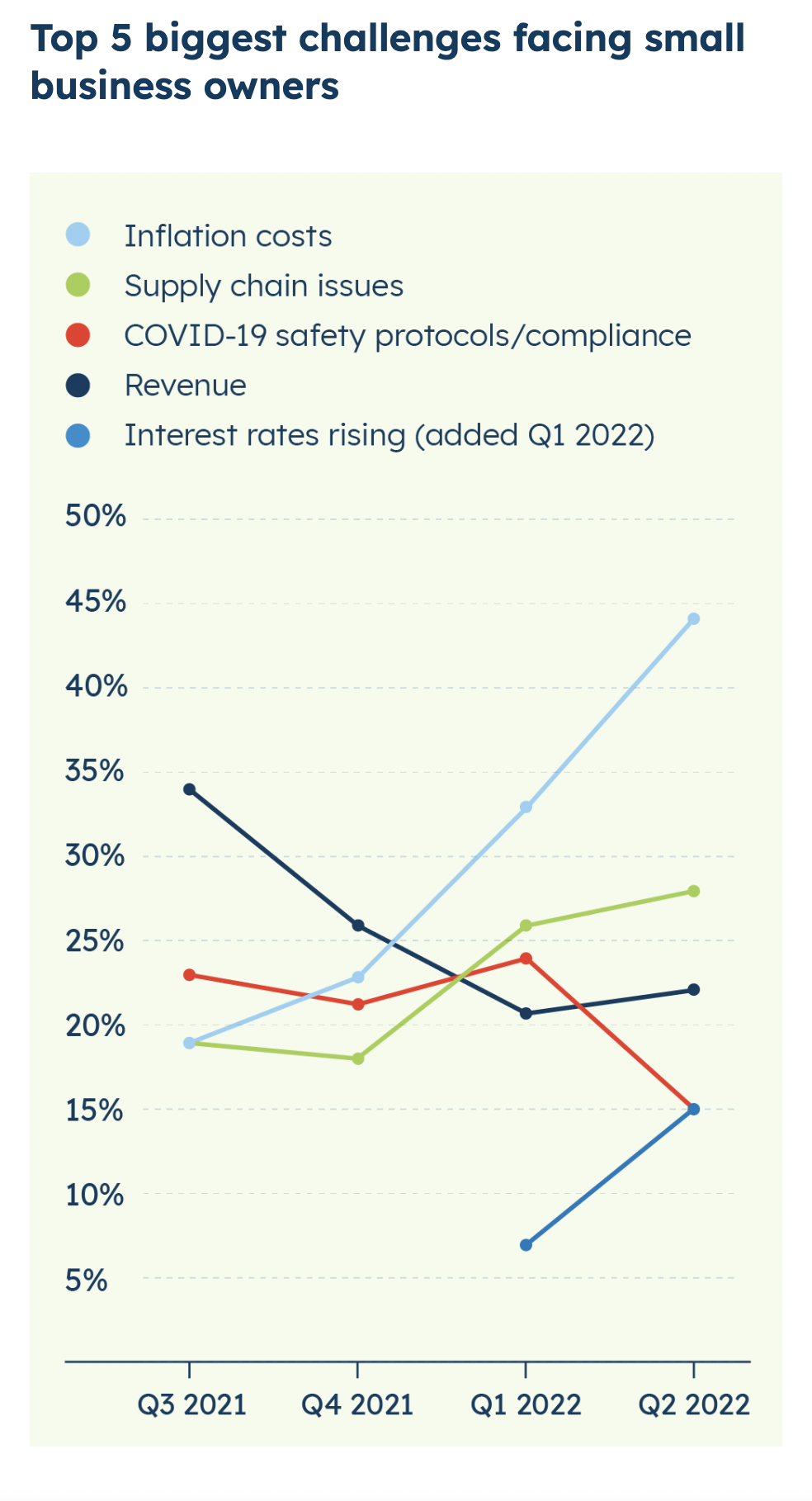

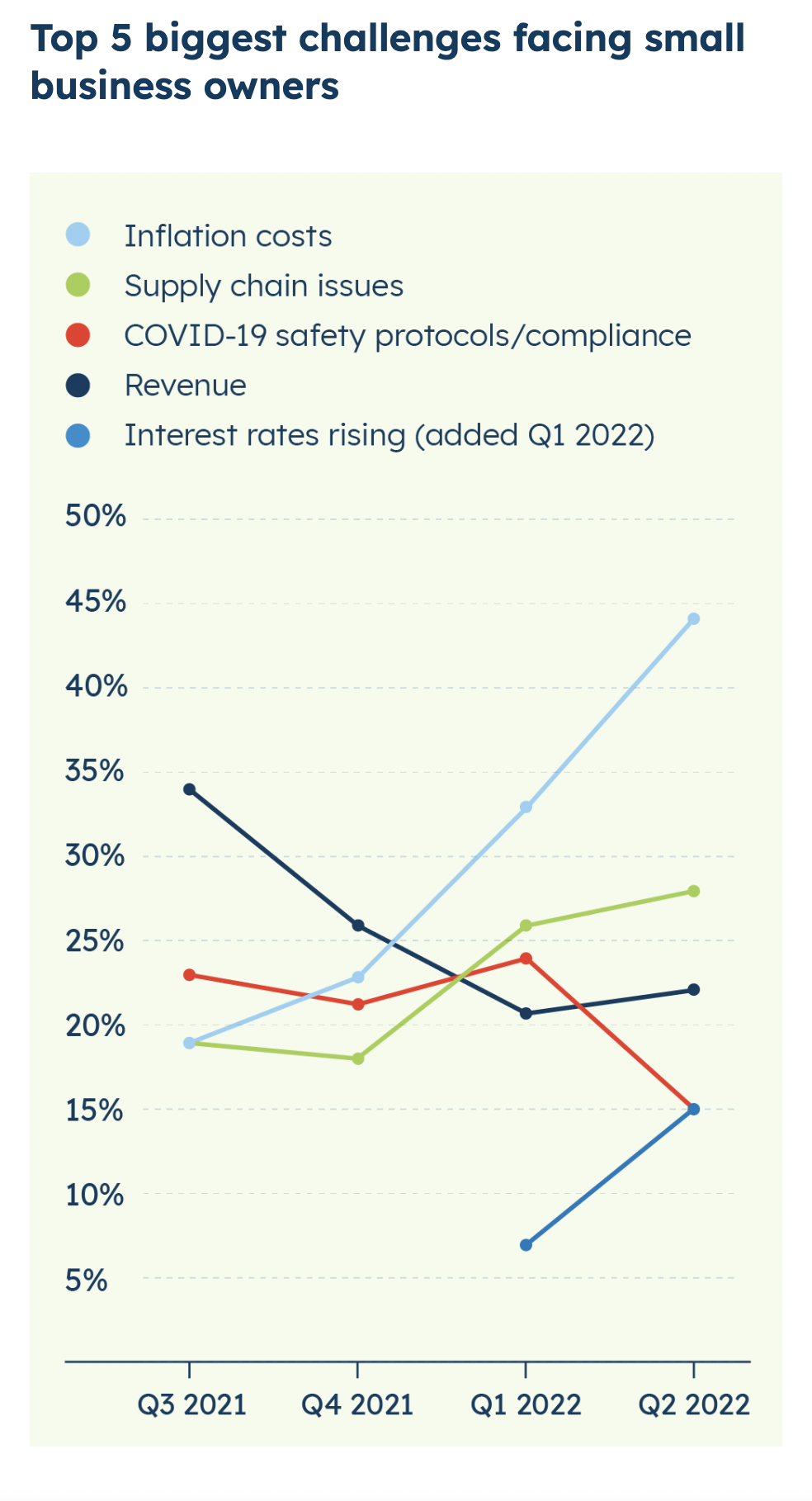

According to the report, as COVID fears begin to subside, small businesses are increasingly preoccupied with inflation and related concerns. 44% of the surveyed small business owner cited inflation as their primary concern, up from 33% in the previous quarter.

Additionally, 88% of the survey participants are worried about how inflation may affect their business, with almost half (49%) saying they are very worried. SMEs also report that higher interest rates are a problem.

Despite this, the Index scored Q2 at 66.8 out of 100, the highest since the COVID pandemic started. This score is slightly higher than the 64.1 from the previous quarter. The pandemic’s low point occurred in 2020 Q2 when the score dipped to 39.5.

The study also found that small businesses are improving and increasing their business health (66%), on par with Q1 2020 (65%), the previous pre-pandemic reading.

When asked about confidence in revenue, about 40% responded with only ‘somewhat good.’ The remaining 26% felt strongly and responded with ‘very good.’

Interestingly, there was an increase in the number of business owners who felt confident in their cash flow. About half (57%) of small businesses with less than five employees felt happy with their cash flow. That number jumps to 77% for small businesses with 5-19 employees and 87% for companies with 20-499 employees.

During the lowest point of the pandemic, less than half (48%) of small businesses had poor cash flow. This number has increased in the second quarter of 2022 to 73%. Staff size is an indicator of cash flow. According to the results, 62% of respondents showed they had maintained the same staff size since last quarter.

Regional Scores

The Small Business Index regional scores can tell small business owners key and specific details about the overall health of small businesses by region.

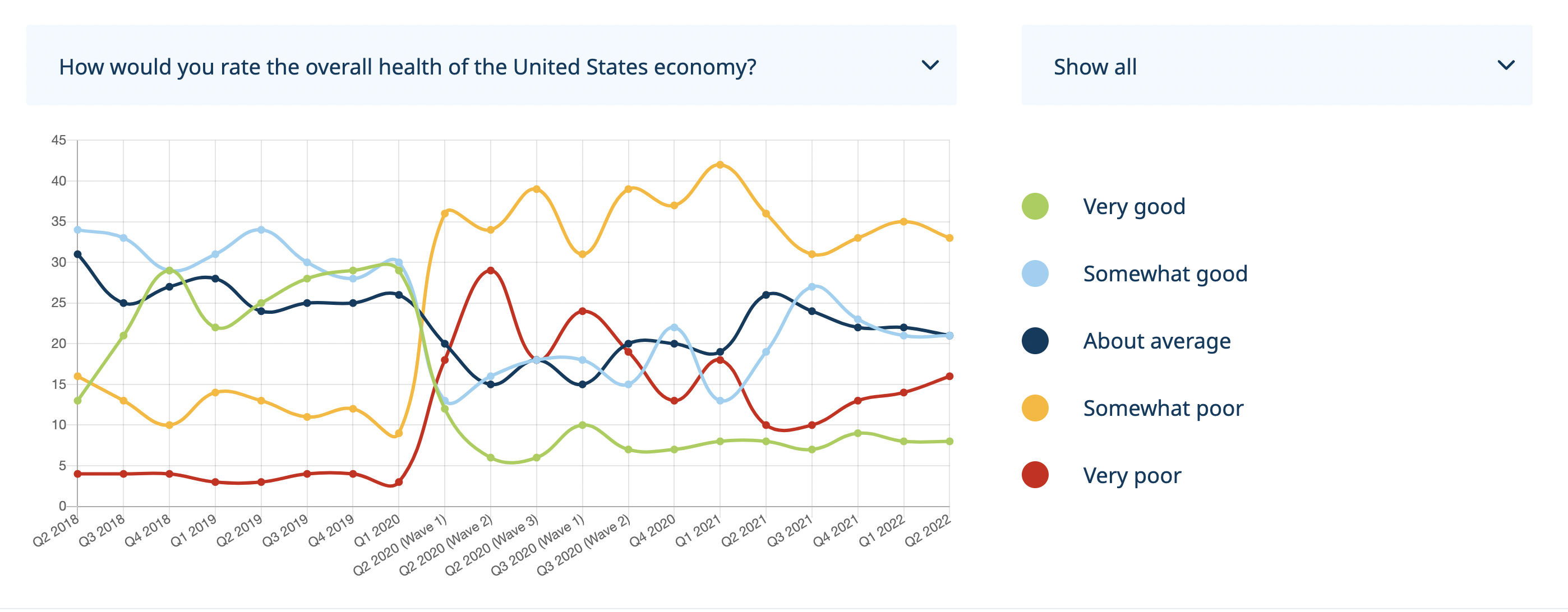

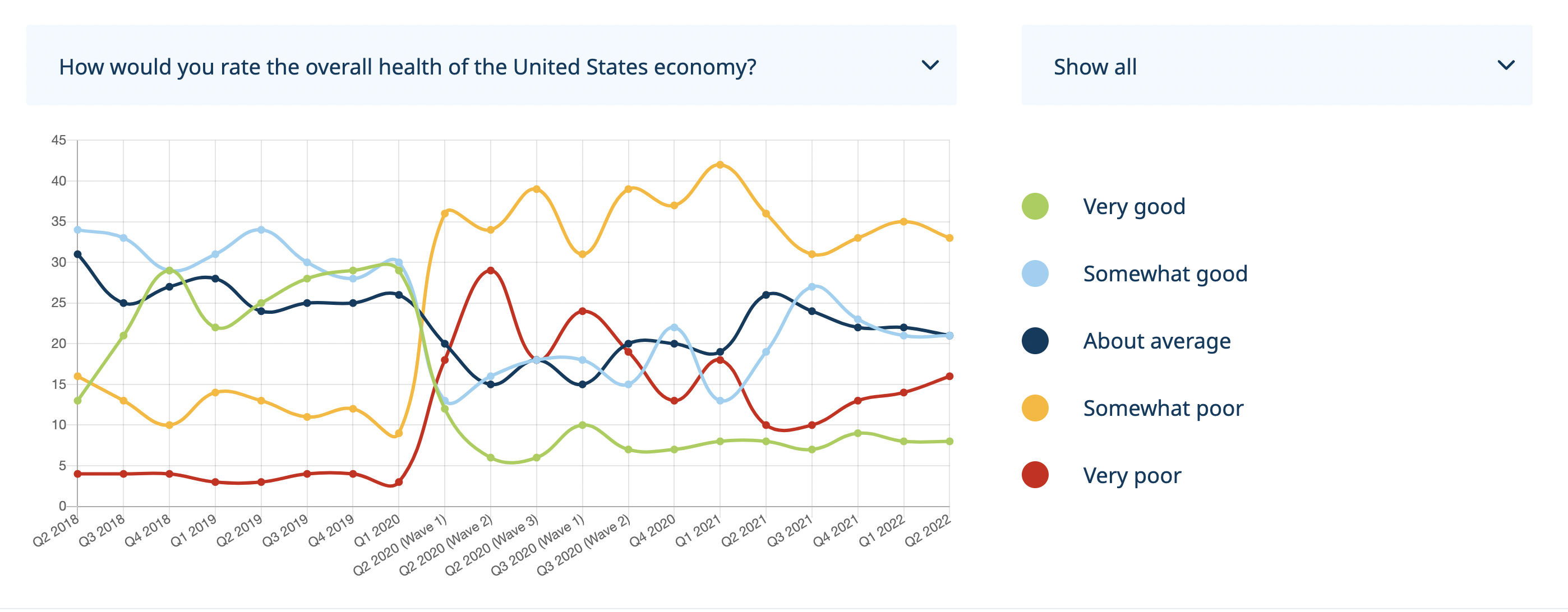

The southern region scored 66.9 out of 100 on the Index, 0.1 points higher than the national average of 66.8. Small businesses in the south (25%) are less optimistic about the U.S. economy than those in the west (35%) and northeast (40%) but more optimistic than the midwest (21%). However, small business owners in the south are more enthusiastic about the state of their local economy (37%) and the state of their business (69%).

The northeast had slightly more small businesses feeling confident in their cash flow than last quarter (76% vs. 70%). 46% of midwestern small business owners also stated that they are more likely to increase staff in the next year. Moving onto the west, approximately two-thirds of small business owners found their small businesses to be in good health. While the health is good, the optimism behind the answers has softened by about 14%.

The Atlanta Small Business Network, from start-up to success, we are your go-to resource for small business news, expert advice, information, and event coverage.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest business news know-how from Atlanta Small Business Network.