Managing cash flow is a critical component of running a successful business. It involves tracking and forecasting the inflow and outflow of money to ensure enough cash is available to meet the company’s financial obligations. The importance of managing cash flow cannot be overstated, as it is one of the key factors determining a business’s financial stability and growth.

A recent study from Intuit showed that 61% of small businesses worldwide struggle with cash flow, and according to a U.S. Bank study, poor cash flow management is to blame for 82% of business failures.

This article will provide an overview of the key strategies for managing cash flow effectively to help ensure the long-term success of your business.

Create a Budget

Creating a budget is one of the essential steps in managing cash flow effectively. It helps you keep track of your expected income and expenses and allows you to plan for the future. A budget also enables you to identify areas where you can cut costs and prioritize spending to make the most of your limited resources. Here are seven tips for creating an adequate budget:

- Make projections frequently: It’s essential to update your budget regularly to stay on top of your cash flow and make adjustments as needed.

- Monitor your net cash position: Your budget should show your net cash position, which is the difference between your available cash and the amount you owe. By doing so, you can see how much moeey you have available for spending and whether you need to bring in more money or cut back on expenses.

- Plan for emergencies: No one knows what the future holds, so it’s a good idea to have an emergency backup plan in place. It could be a savings account set aside for unexpected expenses or a business line of credit you can use when needed.

- Start with your fixed expenses: When creating your budget, start by listing your fixed expenses, such as rent, utilities, insurance, and loan payments. It will help you determine any areas that need adjustment in your budget and give you a good baseline to work from.

- Be realistic with your projections: It’s essential to be realistic when projecting your income and expenses. Factor in seasonality, unexpected events, and other variables that could affect your cash flow.

- Use financial software: Creating your budget with financial software can make the process easier and more efficient. Many financial software programs also have features that allow you to track your expenses and make updates in real-time.

- Review and adjust your budget regularly: Your business and financial situation will change over time, so it’s essential to review and adjust your budget regularly to reflect these changes. Doing so will help you stay on top of your cash flow and make any necessary adjustments to keep your business on track.

Remember, creating a budget ensures you always have enough cash to cover your expenses. By making projections frequently, monitoring your net cash position, and planning for emergencies, you can stay ahead of any cash flow problems and keep your business running smoothly.

Check out this Free Small Business Budget Template from Capterra

Monitor Accounts Receivable

Accounts Receivable (AR) refers to the money a business owes from its customers for goods or services that have been sold but have yet to be paid for. In other words, it’s the money a business expects its customers to receive in the future.

Managing cash flow requires monitoring AR because it shows how quickly customers pay their bills and how much money is coming in. Businesses with thin profit margins need this information because slow-paying customers can quickly drain cash reserves.

Here are some strategies for keeping track of AR:

- Establish clear payment terms: When selling goods or services, it’s essential to have clear payment terms that outline when customers should pay their bills. It will help avoid confusion and ensure timely payments.

- Send invoices promptly: Send invoices promptly after a sale is made to ensure that customers know the amount they owe and the payment due date.

- Use automation tools: Automation tools can help streamline the AR process by automating the billing and invoicing process, reducing errors, and assisting businesses to get paid faster.

- Follow up on overdue payments: When payments are due, it’s essential to follow up with customers promptly to avoid further delays. It can be done by email, phone, or even in person.

- Monitor AR regularly: Regularly monitoring AR will better understand your current cash flow situation and allow you to make adjustments as needed.

By monitoring AR regularly and implementing these strategies, businesses can ensure that they receive payment from their customers on time and maintain a healthy cash flow.

Control Inventory

Inventory management is crucial in ensuring a company has enough money. It immediately affects the company’s cash on hand.

Therefore, when managing inventory, it’s essential to balance having enough products on hand to meet customer demand and having less cash tied up and unavailable for other needs.

Here are some strategies for effectively controlling inventory:

- Manage inventory carefully: Be mindful of how much product you have on hand and how quickly it sells. It’s essential to regularly review your inventory levels and adjust accordingly to prevent overstocking or stock shortages.

- Consider running a sale: If you have a short-term cash flow problem, consider holding a sale to inject cash into your company. It can help eliminate excess inventory.

- Stay aware of business growth, marketing plan, seasonality, and vendor prices: These factors can affect inventory management, so it’s essential to stay aware of any changes and adjust your inventory accordingly.

- Keep detailed records: Maintaining accurate records of inventory levels, sales, and other data can help you make informed decisions about inventory management and prevent problems down the road.

Negotiate Payment Terms

Negotiating payment terms can be crucial in managing your cash flow. When you negotiate payment terms, you are essentially setting the terms and conditions for when you receive payment from customers and pay suppliers. It includes fee due dates, payment methods, and any discounts or incentives that may apply.

The importance of negotiating payment terms lies in the fact that it can help you better manage your cash flow by ensuring that you have enough cash available to meet your business expenses. A good cash flow plan can help avoid problems with cash flow and lead to better financial stability.

To negotiate payment terms effectively, you need to clearly understand your business’s cash flow, including the timing of your expected income and expenses. It would help if you also were flexible and open to negotiation with suppliers and customers. Some tips to help you negotiate payment terms include:

- Offering early payment discounts for customers who pay ahead of schedule.

- Negotiating longer payment terms with suppliers in exchange for better prices or discounts.

- Encouraging customers to use electronic payment methods, such as credit cards or e-transfers, which can speed up the payment process.

- Regularly reviewing and adjusting payment terms to ensure they are aligned with your current cash flow needs.

By following these tips and being proactive in your approach to negotiating payment terms, you can improve your cash flow management and help ensure the long-term financial stability of your business.

Plan for Unexpected Expenses

Unexpected expenses can be a significant challenge when managing cash flow. Having a plan for dealing with these expenses is critical, whether it’s an emergency repair, a sudden downturn in business, or an unexpected opportunity for growth.

Planning for unforeseen expenses is important because it helps you maintain control over your cash flow, even when things don’t go as planned.

To effectively plan for unforeseen expenses, it’s essential to reserve a portion of your income. It is best to keep the reserve in a separate account that is easily accessible, just in case.

It’s also a good idea to regularly review your expenses and adjust your reserves as necessary. You’ll be better prepared to weather unexpected events, keep control of your cash flow, and seize new opportunities if you have a plan in place.

Manage Debt

Managing debt is an essential aspect of operating cash flow for small businesses. It refers to reducing the debt owed and improving the ability to repay it. Debt is critical for managing cash flow as it helps minimize the cost of borrowing and reduces the financial burden of high-interest debt.

Factors that demonstrate the importance of managing debt for cash flow include:

- High-interest debt can be a major drain on cash flow, as a significant portion of revenue is used to repay debt rather than to fund other business operations. For example, if a small business has $100,000 in credit card debt with an interest rate of 20%, it would need to pay $20,000 in interest alone over a year.

- High debt levels can also make it more challenging to get additional financing, as lenders are often hesitant to lend to businesses with high debt levels. This can limit the ability of the company to grow and respond to changing market conditions.

- Interest payments on debt can reduce profitability and the business’s ability to reinvest in itself, as a portion of profits is used to repay debt rather than to fund other business operations.

To effectively manage debt, small businesses can follow the following strategies:

- Minimize the use of credit: By reducing the amount of debt owed, businesses can reduce the cost of borrowing and improve their ability to repay debt. Customers can qualify before credit is extended, and deposits can be required.

- Make early payments on loans: By paying off debt early, businesses can reduce the interest paid over time and improve their overall financial situation. However, it is important to check for prepayment penalties, as some financial institutions charge fees for early debt payments.

- Refinance high-interest debt: For businesses with high-interest debt, refinancing can be a cost-effective way to reduce the cost of borrowing and improve their overall financial situation. For example, refinancing $100,000 in credit card debt with a 20% interest rate to a business line of credit with a 6% interest rate could save a business $14,000 per year in interest payments.

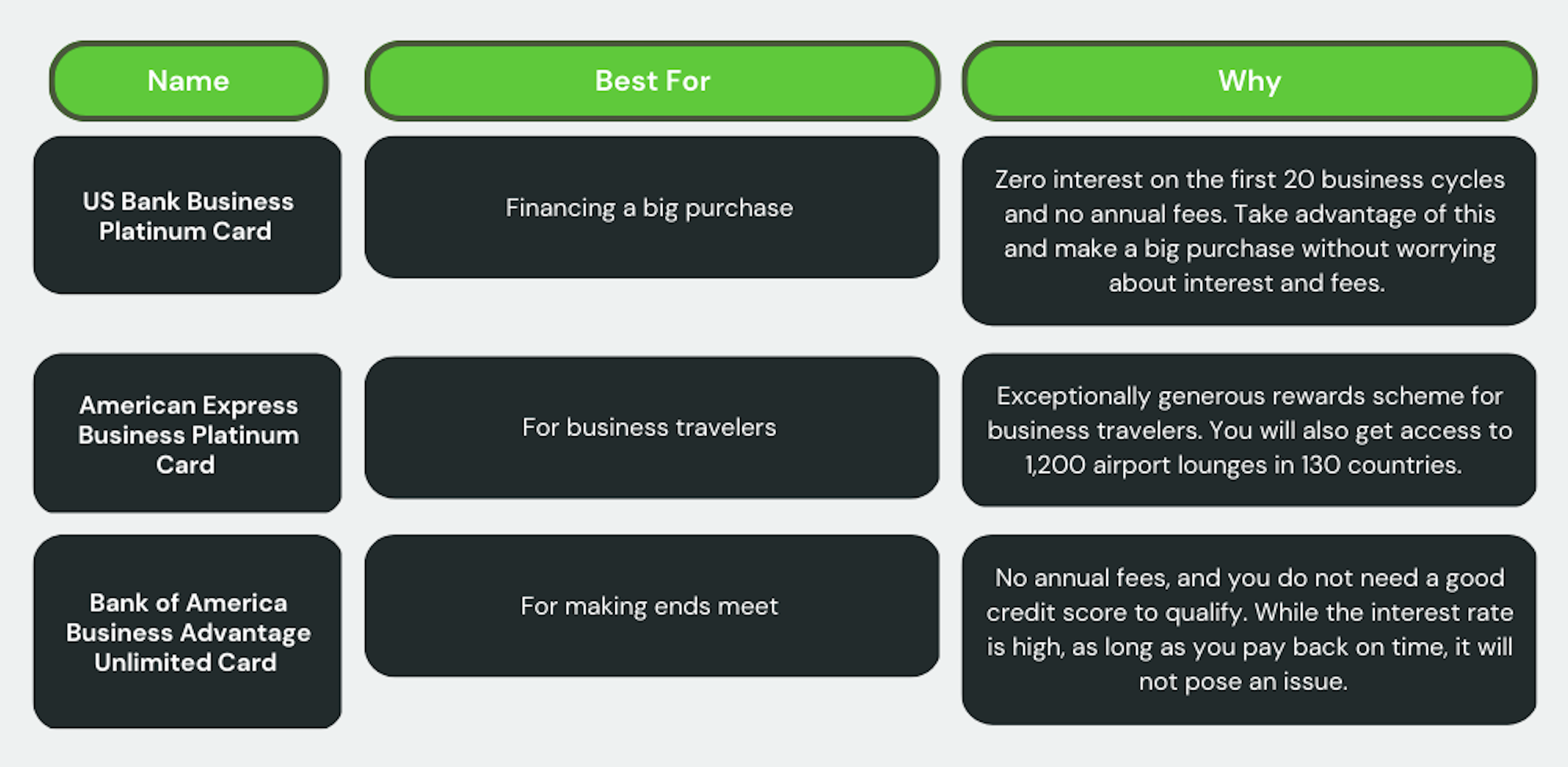

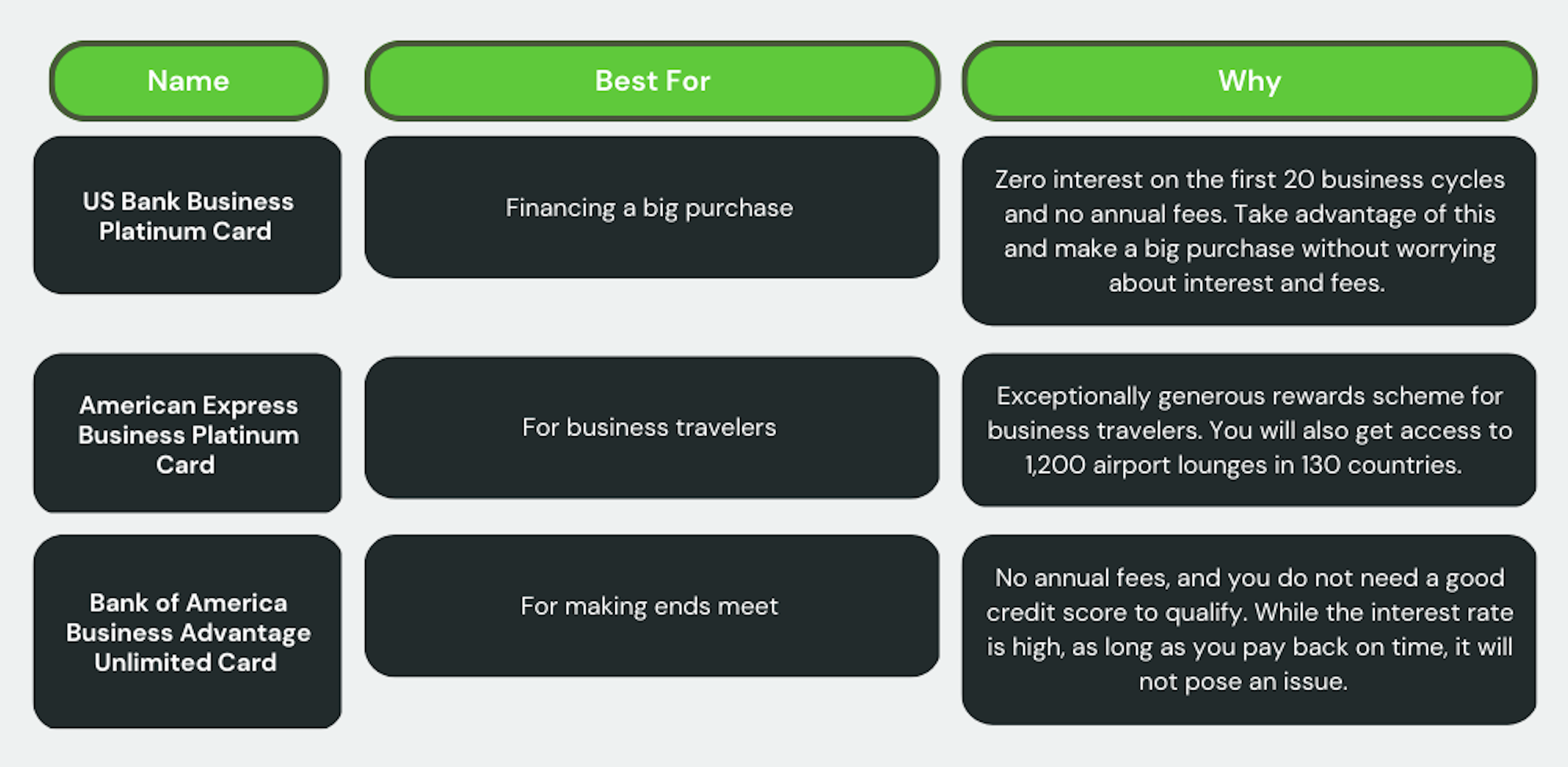

- Use a business credit card with an interest-free grace period: For businesses struggling to get financing, a small business credit card can be a cost-effective way to support short-term financing needs. A credit card can also provide valuable insights into spending trends and help optimize cash flow.

Small firms must manage debt to lower borrowing costs and improve repayment. Small businesses can manage debt and improve finances by adopting the above measures.

Make Smart Investments

Seeking professional advice is important in managing cash flow as it provides valuable expertise, knowledge, and experience that can help you better understand and optimize your financial situation. With the proper guidance, you can make informed decisions that will positively impact your cash flow and overall financial health.

Cash flow is a complex and critical aspect of managing a business, and it’s easy to make mistakes without the proper guidance. By seeking professional advice, you can reduce the risk of financial errors and increase the chances of achieving your financial goals.

Types of professionals to consider for help with managing cash flow:

- Accountants: They can provide valuable advice on tax planning and preparation, financial reporting, and other financial matters that impact your cash flow. They can also help you set up an accounting system that makes it easier to track your financial performance.

- Financial Advisors: They specialize in helping individuals and businesses manage their finances. They can help you create a budget, develop a financial plan, and make informed investment decisions to improve your cash flow.

- Business Consultants: They can provide expert advice on various topics, including operations, marketing, and finance. They can help you identify areas where you can improve your cash flow and provide guidance on achieving your financial goals.

- Bankers: They can provide guidance on financing options, loan structures, and interest rates that can impact your cash flow. They can also help you understand your financial statements and advise on managing debt.

How to find and choose the right professional for your business:

- Ask for referrals: Talk to other business owners and ask for recommendations for professionals who have helped them manage their cash flow.

- Check credentials: Look for professionals who have certifications, such as Certified Public Accountants (CPAs), Chartered Financial Analysts (CFAs), or Certified Financial Planners (CFPs). These certifications indicate the professional has met specific standards of competence and education in their field.

- Schedule consultations: Talk with several professionals and ask questions about their experience, approach, and qualifications. This will help determine which professional best fits your needs.

- Consider fees: Evaluate the fees charged by each professional and compare them to your budget. You want to choose a professional who provides value for your money.

Takeaways

Managing cash flow is a critical aspect of running a successful business, especially as the corporate tax deadline approaches.

Having the right strategies in place can help businesses maintain control of their finances and ensure long-term financial stability. The key strategies for effectively managing cash flow include:

- Automating the billing and invoicing process.

- Following up on overdue payments.

- Regularly monitoring accounts receivable.

- Controlling inventory.

- Negotiating payment terms.

- Planning for unexpected expenses.

- Managing debt.

- Making smart investments.

You can ensure that your business has the financial stability it needs to succeed by taking the time to understand your cash flow needs and implementing these strategies. Having a good handle on cash flow management is critical to running a successful business, and taking the time to develop a plan and make wise investments can help you achieve your financial goals.